Revolutionizing Mortgage Lending

Dominic Iannitti, president and CEO of DocMagic, talked candidly about what the mortgage industry needs to do to improve the lending process.

Dominic Iannitti, president and CEO of DocMagic, talked candidly about what the mortgage industry needs to do to improve the lending process.

With the TRID deadline behind us, the industry is breathing easy again. But should it? Recently ComplianceEase, a provider of automated compliance solutions to the financial services industry, released an analysis of compliance defects for closed loans and estimated that the cost of correcting these errors is increasing the cost of origination, on average, by approximately $28 for every loan. The analysis was based on a cross-section of 700,000 audits that were performed in ComplianceAnalyzer and RESPA Auditor during the first quarter of 2015. It found that 17 percent of the loans failed for Truth in Lending Act (TILA) reasons. Another 6 percent of the loans—or one in 15—failed for being outside of the Real Estate Settlement Procedures Act (RESPA) tolerances.

So, this industry clearly is struggling with compliance. The answer to ironclad compliance is migrating to a truly data-driven process according to Dominic Iannitti, president and CEO of DocMagic. DocMagic is a leading provider of fully-compliant loan document preparation, compliance, eSign and eDelivery solutions for the mortgage industry. Founded in 1988 and headquartered in Torrance, Calif., DocMagic, Inc. develops software, mobile apps, processes and web-based systems for the production and delivery of compliant loan document packages. The company’s compliance experts and in-house legal staff consistently monitor legal and regulatory changes at both the federal and state levels to ensure accuracy. Here’s what Iannitti thinks the industry should do to forever revolutionize lending:

Q: How did you get started in the mortgage industry?

DOMINIC IANNITTI: I was originally very interested in data and putting data together, re-packaging data, and being able to sell data in a different format. I read a story that focused on the manipulation and modification of data. I thought that it was wild to be able to take data, and change it, and format it, and turn that into a marketable service. I immediately got interested in this idea, started to look at technology, and created a business plan for a document production company for the mortgage industry. That’s where it all started. We began to migrate and leverage that data to actually select appropriate forms, to apply rules around that process, and make forms very intelligent. Later we added the ability to electronically deliver those forms. In the end, it’s because of that interest in the raw data that brought me really into the mortgage finance area.

Q: Over the time that you’ve been in the industry, how do you think mortgage lending has changed?

DOMINIC IANNITTI: It’s changed a lot. When we first got involved in mortgage lending, we were delivering documents. We would produce those documents and then literally take the packages out to the car and drive them to the client. We were limited in our reach from a customer perspective. Then modems were created and we had a way to actually send the ones and zeros on the form remotely to another office from another location, which was amazing. Then the laser printer was created and that radically changed documentation. The rules engine behind the document became more powerful. We created our own rules engine within the DocMagic product, which enabled us to be very dynamic in selecting forms and making sure the correct forms were there. Ultimately we were leveraging this technology to pick the client’s rules, validate them, make calculations, ensure regulatory compliance, etc. The industry has changed a lot.

Q: What about Doc Magic as a company? How has it evolved since you started it twenty some years ago?

DOMINIC IANNITTI: When we started DocMagic was very focused on documents. It’s still focused on documents, but it’s become much more of a compliance company, much more of a technology company. So, we were very production oriented in the beginning. You would take in information, and create a document, and manually deliver everything. It was all about documents and creating those documents. Today we have evolved into a compliance company that delivers everything electronically. You could also make the argument that we’ve become a software development company, as well. We’ve had to become very quick at creating solutions, and that means having a large development staff. When we think of an idea we have to create a prototype and ultimately bring a product to market. The company is dramatically different as compared to what it was when we first started off. Now we have one particular department focuses on document production, which is all the original company used to do.

Q: Over the past year, you’ve made two acquisitions, eSignSystems and Document Express. How did they come about? How are things going with them now? Where do you see them going in the future?

DOMINIC IANNITTI: DocMagic has become a very large company. We are serving in excess of 7,000 lending institutions at this point. When requests come in, there’s sophisticating systems and metrics and sophisticated technology to make sure that we’re doing what we promised our clients we would do, service their needs as quickly as possible. We’re always looking for ways to improve that efficiency. Real-time data is coming back from our clients about how we performed. It’s not unlikely that we’ll get somewhere in the neighborhood of 8 to 10,000 requests each week. It’s an insane amount of requests that come into the system. So, when we looked at Document Express, it was a small, boutique company, much the same way we were when we first started out. What we liked about that was the fact that they had a good group of clients and they were very boutique oriented in the way that they were handling those clients. It was very hands on. It was very mundane. It was exactly the opposite of what the company had evolved into. Not to say either one is better or worse, but to say we were interested in that acquisition because it reminded us of what we were when we first started. We looked at that acquisition as a way of bringing that mentality back. When we brought them on, every client that they had stayed with the company. We’ve not lost a single client. The group of people that run that organization are phenomenal and they’ve done an incredible job. We extended our toolset to them, as well. Their systems now integrate to all of the DocMagic clients, the DocMagic calculations, and the DocMagic evolving and electronic delivery technologies.

The eSignSystems relationship is a little bit different. There was a different motivation for that acquisition. DocMagic focuses on the mortgage industry and we learned during the time that we were trying to transition the industry to start to think about DocMagic as a compliance company, which we felt was critical, that was an uphill battle. When people think of you as a document production company, it’s difficult to change that mindset. We have been on the cutting edge of electronic delivery, and electronic signature technology here at Doc Magic. All of that is integrated into the Doc Magic products. Our clients don’t have to go out and look for an electronic delivery service because those services are tightly woven into the very fabric of our product because we have that expertise. We realized that in order for the mortgage marketplace, and other industries as well, to consider adopting an electronic signature strategy, it would be necessary for us to bring on another company that has that expertise as a strategic advantage. eSignSystems had great technology. Most of their technology was designed to be on premise. It was designed for much, much bigger organizations. So, we felt that the marriage of the two companies would be great. We would bring our SaaS offering together with the on-premise offering at eSignSystems. Now very large organizations could come to us and we would have the right solution for them. We’ve been doing a lot of work retooling their technology, as well. eSignSystems also gives us the ability to reach beyond the mortgage industry, and expand to serve other industries. For example, now we have a number of insurance clients and we’re hoping to bring on some automotive dealerships. That’s been very exciting.

Q: Are you still in an acquisition mode? Are you actively looking for other acquisitions? Or do you think that those acquisitions were just opportunistic that came up at the time? How would you describe your M&A strategy?

DOMINIC IANNITTI: We’re always actively looking. There are certain companies that we are always watching. We’re also opportunistic at the same time. If the situation presents itself and we feel that we can it work, we are open to acquisitions. Our eyes are always open and we’re absolutely keeping a very close watch on a number of different types of companies that we’re very interested in.

Q: You recently launched a product called SmartCLOSE. Describe the evolution of the product. What’s the value proposition behind the product and where you see it going in the future?

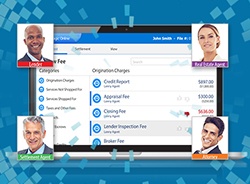

DOMINIC IANNITTI: We realized very early on that collaboration is going to be key to making the mortgage system work. Lenders, settlement agents, and other have to collaborate and the changes to the loan that happen as a result of that collaboration need to happen in real time. If I’m in the system and I make a change, but you don’t see it for five minutes, that’s not collaboration. We researched and came up with a new technology stack that would enable us to provide real-time collaboration, much the same way that Google Docs works. We wanted to allow for real-time updates. If I’m in the system, the settlement agency sees exactly what I’m doing. It is truly dynamic. If I make a change and I need to make sure you know about that change, SmartCLOSE will notify you. So, the communication within the system is very sophisticated. If you’re in the system you will see the update in real time and if you are not in the system you will be notified of the update in real time.

In addition, the system handles data. It handles an immense amount of data. That data moves and hits the disclosure forms, for example. So, the forms are created and updated dynamically. The system also maintains a record of all the changes. I can go into, for example, the origination fee and I can see in that fee all the communication, conversations, and messages that went on about that fee. You know who made every change and why they made that change. We had no idea when we started the project how important communication was. At every step the system is creating a record and audit log.

The most exciting part about SmartCLOSE is the fact that it establishes the relationship between the lender and the settlement agency. That just never existed before. Again, it’s so simplistic, but it comes down to communication. Really, if you play in this arena, you faxes and e-mails and all kinds of things going back and forth, but there’s nothing that brings it all together. There’s nothing that unites all of those communications. SmartCLOSE does that.

Q: DocMagic surpassed 100 million e-signed transactions this year. How did you do that?

DOMINIC IANNITTI: What’s really exciting is that we can create these disclosures perfectly with e-signatures. We feel like we are uniquely situated to move the industry forward when it comes to the usage of electronic signatures. We are so proud of our e-signature number. We have even opened up this service to other industries. You can bring your own docs into our system and apply an electronic signature even if you are not in mortgage. We also have strategic alliances with other companies where they will leverage our electronic signatures for appraisals, for example. There has been an outpouring of interest in electronic signing.

Q: What’s the future of doc prep as an industry category within mortgage lending?

DOMINIC IANNITTI: Doc prep has become much more dynamic. For example, closing disclosures get messy really fast if you’re just using templates. The reality is that you have to create a document dynamically for closings to work these days. Very early on DocMagic realized that there has to be a lot of intelligence embedded in the form itself. For example, our documents can audit themselves. So, if a calculation is wrong it will throw that alert back into the main system to show that something may be out of compliance. In that case, the doc is actually performing a regulatory audit on itself. Increased intelligence within mortgage documentation is something that you are going to see more and more of.

INSIDER PROFILE

Dominic Iannitti is President and CEO of DocMagic, Inc., the mortgage industry’s preeminent provider of fully-compliant loan document preparation, compliance, eSign and eDelivery solutions. Since founding the company in 1988, Iannitti has been responsible for the company’s wildly successful track record as a leader in closing loan document production software and eServices solutions. DocMagic’s innovative technology and company growth is the result of his leadership and vision. Most recently, Iannitti spearheaded the development of SmartCLOSE™, the leading Collaborative Closing Portal for TRID compliance.

INDUSTRY PREDICTIONS

Dominic Iannitti thinks:

1) Most collaboration closing portals for TRID will fail, with only a handful being viable long-term solutions.

2) Current TRID requirements and the CFPB’s commitment to eClosings will drive lenders to implement a true eClosing process — sooner rather than later.

3) Because of QM, ATR and now the TRID MISMO 3.3 data requirement, many investors will push their post closing QC process to a more automated pre-closing QC process that ensures better data and document integrity, compliance and control.

TRID went live on Oct. 3. Some industry analysts say one consequence of the new consumer-disclosure rules will be that paperless eMortgages will become standard in the post-TRID world. Tim Anderson, director of eServices for DocMagic, spoke to Scotsman Guide News on why the regulations and consumer preferences might inevitably push the industry toward a paperless mortgage.

TRID went live on Oct. 3. Some industry analysts say one consequence of the new consumer-disclosure rules will be that paperless eMortgages will become standard in the post-TRID world. Tim Anderson, director of eServices for DocMagic, spoke to Scotsman Guide News on why the regulations and consumer preferences might inevitably push the industry toward a paperless mortgage.  Press Release:

Press Release: The one-month countdown until the TILA-RESPA Integrated Disclosure (TRID) rule is implemented is in full effect. This checklist of the critical items you will need to will not only ensure compliance, but more importantly deliver the electronic evidence when the Consumer Financial Protection Bureau (CFPB) comes knocking on your door asking you to prove what you said you did to prevent paying fines that could run up to $1 million dollars a day per infraction!

The one-month countdown until the TILA-RESPA Integrated Disclosure (TRID) rule is implemented is in full effect. This checklist of the critical items you will need to will not only ensure compliance, but more importantly deliver the electronic evidence when the Consumer Financial Protection Bureau (CFPB) comes knocking on your door asking you to prove what you said you did to prevent paying fines that could run up to $1 million dollars a day per infraction! Press Release

Press Release Press Release:

Press Release:

Press Release:

Press Release: Press Release

Press Release