CFPB rescinds 7 pandemic-related policy statements

The Consumer Financial Protection Bureau has announced that it is rescinding seven policy statements that were issued last year to assist financial institutions during the height of the pandemic. Issued between March 26 and June 3, 2020, the policy statements provided some flexibility in complying with certain regulatory filings and consumer finance laws.

The rescission date for the policy statements was April 1, 2021. The CFPB stated in each policy rescission that it would not be providing a notice and comment period as it would with rulemaking. The statements are intended to provide information regarding the CFPB’s plans to exercise its supervisory and enforcement discretion, which does not impose any change to existing legal requirements.

The rescinded policy statements include:

- March 26, 2020: Statement on Bureau Supervisory and Enforcement Response to COVID-19 Pandemic. The statement provided that the CFPB would look at good-faith efforts to assist consumers while taking into consideration staffing and related resource challenges related to the pandemic.

- March 26, 2020: Statement on Supervisory and Enforcement Practices Regarding Quarterly Reporting Under the Home Mortgage Disclosure Act. The statement provided that until further notice, the CFPB would not bring an action for failure to report HMDA data quarterly as required. The rescission states that financial institutions must resume quarterly HMDA data submissions starting with 2021 first quarter data.

- March 26, 2020: Statement on Supervisory and Enforcement Practices Regarding CFPB Information Collections for Credit Card and Prepaid Account Issuers. The rescission statement provides guidance on how supervised entities should follow information collections requirements for credit card and prepaid accounts.

- April 1, 2020: Statement on Supervisory and Enforcement Practices Regarding the Fair Credit Reporting Act and Regulation V in Light of the CARES Act. The rescission statement advises the CFPB will resume full supervisory and enforcement activity, but still encourages financial institutions to provide and report payment relief actions.

- April 27, 2020: Statement on Supervisory and Enforcement Practices Regarding Certain Filing Requirements Under the Interstate Land Sales Full Disclosure Act (ILSA) and Regulation J. The rescission ends flexibility provided to land developers and other entities subject to ILSA related to filing annual reports and financial statements.

- May 13, 2020: Statement on Supervisory and Enforcement Practices Regarding Regulation Z Billing Error Resolution Timeframes in Light of the COVID-19 Pandemic. The rescission ends flexibility of enforcement for the handling of consumer dispute requests by financial services entities.

- June 3, 2020: Statement on Supervisory Enforcement Practices Regarding Electronic Credit Card Disclosures in Light of the COVID-19 Pandemic. The statement provided that the CFPB would not cite a violation or bring an enforcement action if an issuer did not obtain oral consent for certain electronic disclosures. As financial institutions have now had time to improve operations and servicing procedures, the CFPB will no longer provide flexibility in enforcement of TILA and Regulation Z violations.

Additionally, the CFPB released Bulletin 2021-01 on March 31, 2021, which rescinds and replaces Bulletin 2018-01, issued on Sept. 25, 2018. The new Bulletin announced that the CFPB will no longer issue formal written Supervisory Recommendations. Instead, examiners will issue Matters Requiring Attention (MRAs) to express expectations to supervised entities, with or without a related finding of a violation. The MRAs should include specific goals and corrective actions to be taken, along with a specific timeline for actions.

Related Content:

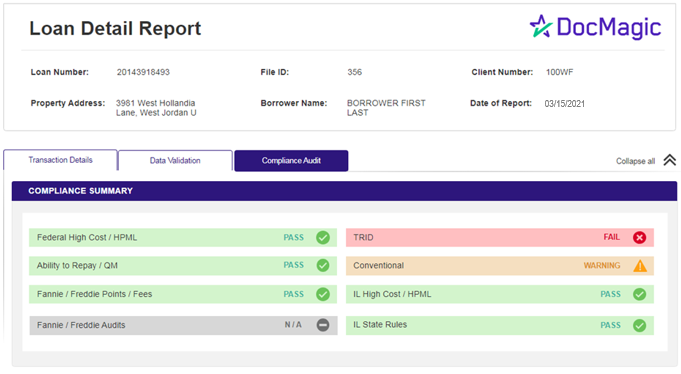

Good data validation is crucial. For a variety of reasons (such as how the data is received, the size of the required data set and the complexity of the information), information may be incomplete, incorrect or improperly formatted — potentially causing major disruptions for lenders later on in the process. Lenders need a

Good data validation is crucial. For a variety of reasons (such as how the data is received, the size of the required data set and the complexity of the information), information may be incomplete, incorrect or improperly formatted — potentially causing major disruptions for lenders later on in the process. Lenders need a