The redesigned URLA will be required in a few months; are you ready?

(2/27/21 update: The new URLA: The No. 1 thing to do ASAP to ensure you're ready)

Starting March 1, 2021, all lenders who intend to sell closed residential mortgage loans to Fannie Mae or Freddie Mac will be required to use the new Uniform Residential Loan Application (URLA), the standard form that borrowers use to apply for a mortgage loan.

It’s a significant change for the mortgage industry; in fact, when the GSEs first announced the news in August 2016, it was the first substantial change to the form in 20 years.

How a new lender found success amid the pandemic: Download the MortgageCountry case study

The goal is to have a more consumer-friendly loan application experience while also moving the lending industry closer to digitizing the loan origination process.

Here are some of the key things you should know:

Biggest changes on the form

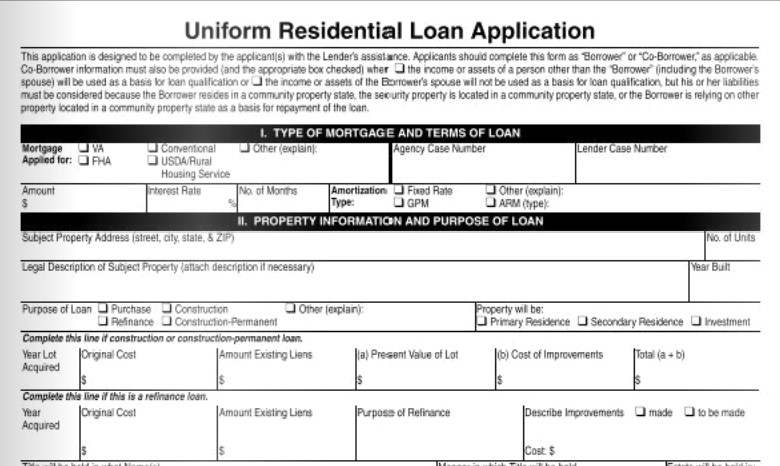

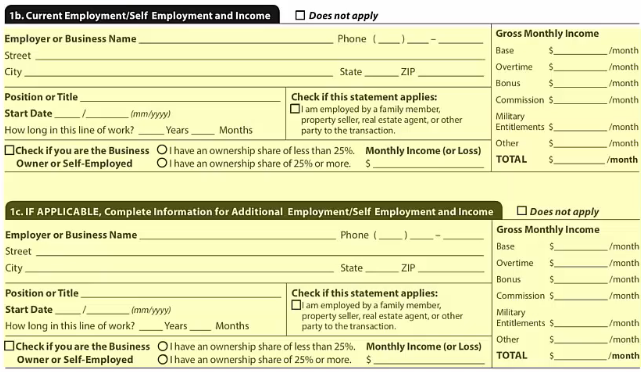

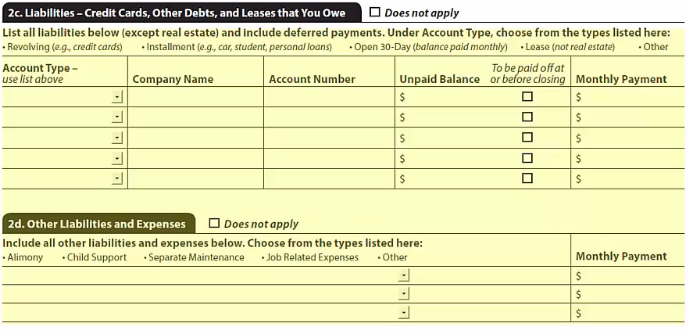

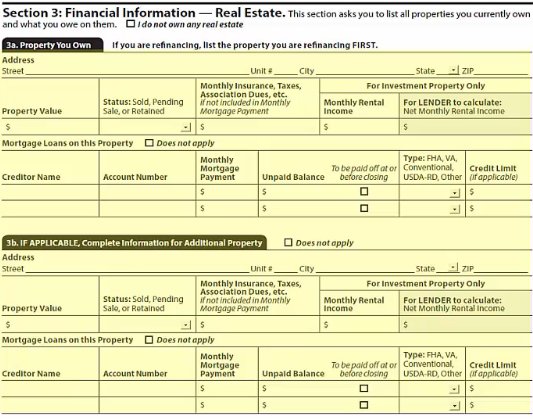

The redesigned URLA will replace Freddie Mac Form 65 and Fannie Mae Form 1003 and will require lenders to request more borrower information than ever before. It will have 94 new data points for a total of 236 data fields—making it 129% bigger than the previous form.

The new data fields includes information such as borrowers’ mobile phone numbers and email addresses; military service history; current housing expenses; and additional demographic information, designed to comply with the Home Mortgage Disclosure Act and eliminating the need for the previous demographic information addendum.

The new data fields includes information such as borrowers’ mobile phone numbers and email addresses; military service history; current housing expenses; and additional demographic information, designed to comply with the Home Mortgage Disclosure Act and eliminating the need for the previous demographic information addendum.

At the same time, the updated form is removing obsolete fields, such as requiring applicants to list their car’s make and model.

The redesigned URLA will also use clearer language and have a new layout that makes the information easier for technology to ingest, supporting the move toward digitization.

Shifting timelines

The date by which all lenders would be required to use the redesigned URLA has been repeatedly postponed. When the GSEs first announced the change in 2016, the new URLA was slated to be available in January 2018, with no mandated use-by date announced.

The GSEs later announced the mandatory implementation date would be Feb. 1, 2020. Late last year, however, at the direction of the Federal Housing Finance Agency, the required implementation date got pushed back to Nov. 1, 2020.

But that plan also got upended, this time by the pandemic. In April, the GSEs pushed back the mandated implementation date to March 1, 2021.

In the meantime, limited production began on Aug. 1 and open production will begin Jan. 1, 2021. The current URLA will be retired on March 1, 2022.

For more details on the current implementation timeline, check out this update from our Compliance Edge newsletter.

What else lenders need to consider

With so many new data requirements, lenders should get ready now for the new URLA to avoid any disruption to their business. For a time, lenders may need to be prepared to support both the old and new URLA forms concurrently.

Lenders should start by ensuring their LOS will offer end-to-end support for the redesigned form. Other technological updates will also be necessary; for example, those using static web contact forms will likely need to update their technology stack.

Lenders need to communicate with their investors about where they are in the transition process. If the investors don’t also standardize on the new MISMO format, it may be more difficult and expensive for lenders to sell loans.

Related Content:

.jpg)

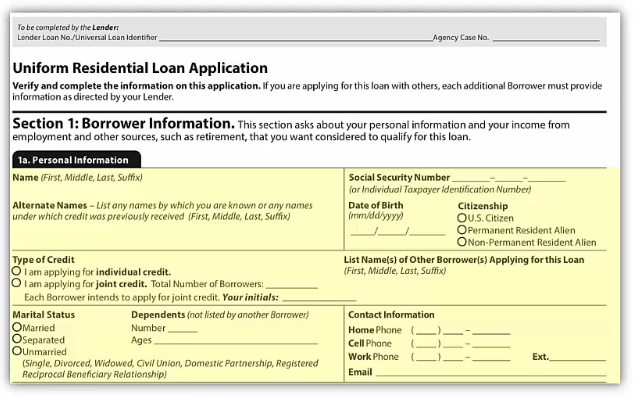

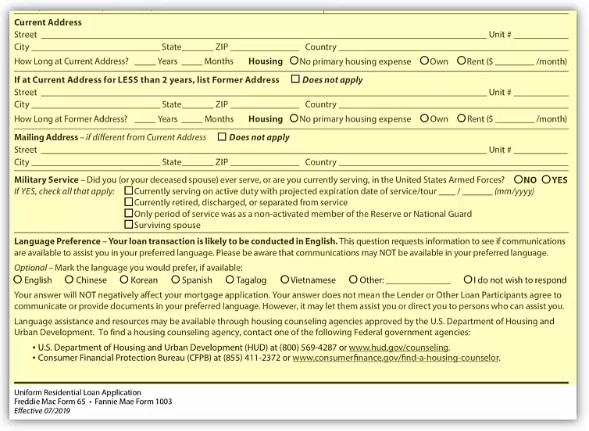

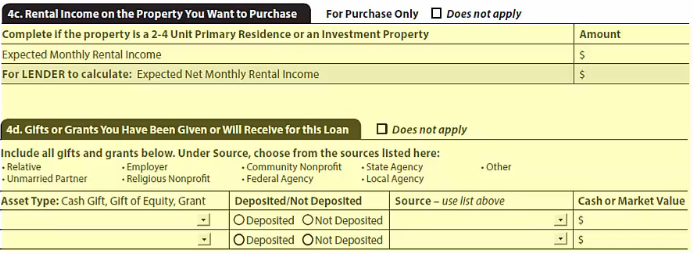

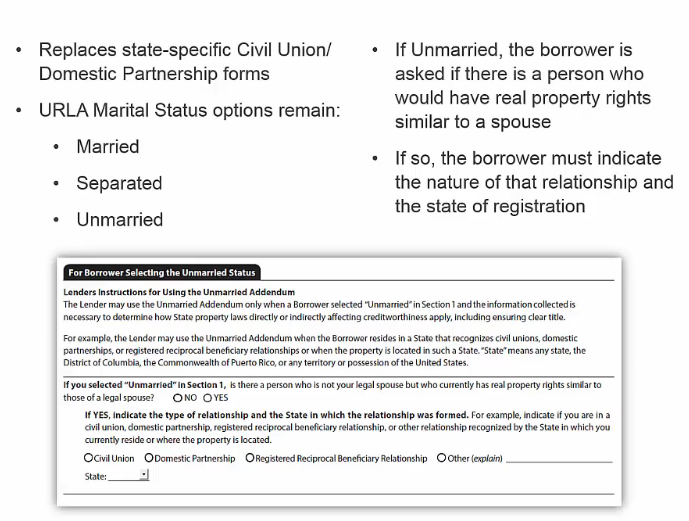

There are two new sections within the personal information section of the Borrower Information Document.

There are two new sections within the personal information section of the Borrower Information Document.

Gavin T. Ales is DocMagic’s Chief Compliance Officer. He has hands-on involvement in the development, implementation and maintenance of DocMagic’s compliance products and services. This includes managing DocMagic’s library of mortgage loan documents, which are used by lenders and brokers in all 50 states and the District of Columbia, monitoring legal and regulatory changes, and developing and maintaining DocMagic’s automated compliance tests and audits.

Gavin T. Ales is DocMagic’s Chief Compliance Officer. He has hands-on involvement in the development, implementation and maintenance of DocMagic’s compliance products and services. This includes managing DocMagic’s library of mortgage loan documents, which are used by lenders and brokers in all 50 states and the District of Columbia, monitoring legal and regulatory changes, and developing and maintaining DocMagic’s automated compliance tests and audits.

Join us at the 2017 Digital Mortgage Conference in sunny San Francisco, CA! At DocMagic, our goal is to make it easy for you to implement successful Uniform Closing Dataset (UCD) submissions to the GSEs.

Join us at the 2017 Digital Mortgage Conference in sunny San Francisco, CA! At DocMagic, our goal is to make it easy for you to implement successful Uniform Closing Dataset (UCD) submissions to the GSEs.