California Passes Remote Online Notarization Bill

This post is adapted from a detailed update on the new SB 696 bill in our Compliance Edge publication authored by Gavin T. Ales, Chief Compliance Officer at DocMagic.

On Saturday, September 30th, the California governor signed a bill into law, SB 696, that paves the way for legalization of remote online notarizations (RON) by California notaries. The groundbreaking piece of legislation has stipulations to review the technological requirements for RON, study laws of other states governing remote notarization, and determine appropriate regulations and rules necessary to enable the conduct of remote notarizations.

However, what sets this legislation apart is its forward-looking approach, with its full scope perhaps not becoming effective until years after its passage.

The legislation also requires the Secretary of State to conduct a Technology Project to assess the technological requirements for RON. The bill would enable remote notarizations within the state at the completion of the Technology Project, or in accordance with rules passed as part of that process, or in the event the project is not completed by the later effective date, would authorize remote notarizations on January 1, 2030. The new law will include some of the common, familiar requirements for remote notarization that other states have also included with their legislation. Unlike many other states, though, California did not simply adopt a version of the Revised Uniform Law on Notarial Acts (published by the Uniform Law Commission). The law will require credential analysis and identity proofing, a requirement for keeping an electronic journal for a period of 10 years, which may be done with the notarizing platform or another registered depository, and use of an image of the notary public’s electronic signature with an electronic notarial certificate that includes a notation that the notarial act was completed via audio-video communication technology. Remote notarization platforms and journal depositories will be required to seek approval from the secretary’s office prior to offering such services in the state, and approval cannot be sought until the Technology Project is completed.DocMagic will continue to monitor developments on remote notarizations in California as the Secretary of State’s office proceeds through the steps for completing the required Technology Project.

Related Content:

Ask the eClosing Team: Unlocking the potential of hybrid eClosings

When a lender comes to us requesting a digital mortgage closing transformation, we often recommend a “crawl, walk, run” strategy: in other words, we encourage them to transition through various stages of hybrid electronic closings (eClosings) before going 100% digital.

This phased approach is often helpful for newly digital lenders, but we still have clients who approach us with a desire to go full eClosing from the start.

Our eClosing Team expert, Leah Sommerville, firmly advocates for a phased approach to implementing eClosing for all lenders—particularly the adoption of hybrid eClosings with an experienced vendor. In this interview, .jpg) Sommerville shares the reasons why lenders should consider the phased approach, and we delve into various forms of hybrid eClosings and provide insights into measuring your ROI as you implement hybrids.

Sommerville shares the reasons why lenders should consider the phased approach, and we delve into various forms of hybrid eClosings and provide insights into measuring your ROI as you implement hybrids.

Q: First things first. Would you still recommend a phased eClosing approach for lenders, and why?

A: I wholeheartedly endorse the phased approach for all lenders. Waiting indefinitely for the perfect moment when every aspect of lending can be electronic is, unfortunately, a flawed strategy. The reality is that not every loan can be purely electronic due to some lingering investor restrictions, geographical limitations, and other constraints.

However, a hybrid eClosing allows lenders to enjoy digital benefits now. They can see the increased efficiency, the quicker closings, and the increased cost savings. Borrowers today also expect a digital experience, from online applications to e-signing initial disclosures, and lenders should strive to align with these expectations.

Q: Why should lenders consider hybrid eClosing before going to 100% eClosing?

A: There are several compelling reasons why the phased approach, starting with hybrid eClosings, is a good choice.

- Empowering borrower document review: Hybrid eClosings allow borrowers to review documents ahead of the closing day, aligning with their digital journey and giving them more confidence in the process.

- Facilitating internal team familiarity: Implementing eClosings all at once can overwhelm internal teams within lending institutions. A phased approach eases the transition and allows teams to adapt gradually.

- Navigating compliance and MERS® membership: Setting up MERS® membership, a prerequisite for eNotes, can take 3-6 months. During this period, lenders can become accustomed to the digital workflow if they’re already using the first category of hybrid eClosing (see below).

- DocMagic's eDecision tool for compliance: If they’re using DocMagic to generate digital documents, lenders can start using our eDecision audit, described in our Loan Detail Report, to assess where notarization can be applied in advance of actually deploying an eNotarization solution. This ensures compliance and streamlines the evolution toward a complete eClosing workflow once they scale up.

- Meeting borrower expectations: Modern borrowers conduct most of their mortgage-related activities online. Providing a digital experience up to the closing stage is essential.

Q: What types of hybrid eClosings does DocMagic provide, and what do those categories involve?

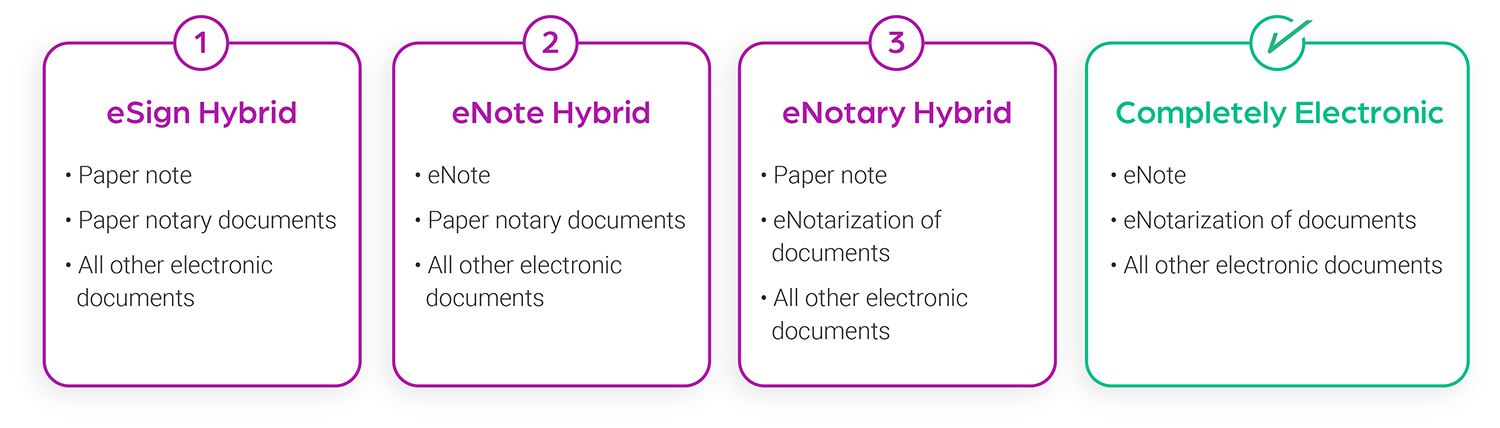

A: DocMagic offers a spectrum of hybrid eClosing options tailored to diverse lender needs:

With the first category of hybrid eClosing, eSigning (with DocMagic, that’s covered by our ClickSign® tool) is the focus. Borrowers can preview the closing package as soon as it’s generated, with about 90% of the package available for electronic signing. Notarization and wet signatures are still required for the promissory note and select documents, but they usually only amount to 3-4 pages as opposed to dozens.

Building on the first level, the second category of hybrid incorporates electronic notes (eNotes) stored in an eVault, facilitating quicker funding and seamless transfer to investors or warehouse lenders through integration with MERS®.

In the last category of hybrid, ancillary documents can be eSigned but eNotarization is also possible, reducing the need for wet signatures. Typically, only the promissory note requires wet signing in this type of hybrid. Also—and this is not always done, but it’s still possible—since the note doesn’t require notarization, the borrower could even print out the note at home, sign it, and re-upload it into the lender’s eClosing portal, facilitating an even faster certification process.

Each of these hybrid eClosing options offers varying degrees of efficiency and digitization, helping lenders transition gradually to a more advanced eClosing workflow.

Q: What are some key indicators that lenders can use to measure the ROI they want from hybrid eClosings?

A: Lenders can gauge the ROI of their hybrid e-closings by considering several metrics.

First, if eNotes are part of the hybrid workflow, measuring how quickly they are funded can show lenders just how significantly an eNote impacts efficiency and cost savings.

Evaluating the time borrowers spend at the closing table is also crucial. Hybrid eClosings often lead to much shorter sessions at the closing table, indicating a smoother process even without a 100% digital workflow.

Another strong ROI indicator is a decrease in undersigning errors, oversigning errors, and missed documents when lenders receive documents from the settlement agent. Less human error translates to cost savings and quicker closings overall.

Lastly, assessing borrower satisfaction with the hybrid eClosing experience is vital. Satisfied borrowers are more likely to recommend the lender's services and spread the word about quick, convenient closings.

Q: What recommendations do you have for lenders who still want to implement 100% digital eClosing from the start?

A: Definitely appoint a strong project stakeholder. A dedicated and experienced project stakeholder will lead the transition to full eClosing from planning to implementation. This individual should be the driving force behind the project, ensuring it reaches successful completion.

Also, be mindful and recognize that some benefits of eClosings may not be fully realized until reaching the 100% eClosing stage—therefore, know that lenders starting with hybrid may gain these benefits right away, while lenders going 100% digital may have to wait for MERS® approval or other independent organizations.

In the end, Sommerville emphasized that staying on track and avoiding delays is essential. It’s better to progress and adapt than to wait indefinitely and potentially fall off track—so whether you choose a phased approach with hybrid eClosings, or whether you pursue 100% digital from the start, getting started is the most important action to take.

Related Content:

100% Digital, 100% Delight: eClosing means great customer experiences

In the rapidly evolving landscape of modern lending, the integration of cutting-edge technology with exceptional customer service has emerged as a paramount strategy for success.

This was the core theme of our recent webinar—“100% Digital, 100% Delight: Prioritizing Customers in the Digital Age.” Hosted by industry experts, the event shed light on the transformative power of eClosing and its impact on the lending experience.

Missed our eClosing webinar? Here's the full recording.

In case you didn’t catch this conversation between Leah Sommerville (Enterprise Solutions Manager at DocMagic), Kurt Neeper (President of Superior Financial Solutions), and Megan Schroeder (Director of Mortgage Loan Operations at Superior), read on for a recap of the takeaways.

Delight In Digital: A Paradigm Shift For eClosing Support

Sommerville, the host of the webinar, opened by emphasizing the significance of blending technology and customer-centric approaches. The objective: providing customers with a seamless and efficient mortgage experience.

With customers expecting nothing less than streamlined processes, digital tools like eClosings have come to the forefront—with the added need for providing considerate eClosing support to all, especially new buyers.

The Pioneering Superior Credit Union

Neeper delved into Superior Credit Union’s history, highlighting their legacy of “firsts.” From starting community charters to owning a title company and real estate brokerage, Superior has consistently been an innovator. Their focus on being the first choice for various financial needs propelled them to set the bar high: they would achieve 100% paperless eClosings, and they would do it from the start.

Although hybrid eClosings and full eClosings are two choices among many lenders can make to fit their needs, Superior Credit Union fully embraced the concept of digital, said Neeper. This decision proved immensely effective in not only speeding up the closing process but also optimizing operational efficiency.

Paving The Way For Better Customer Service

Schroeder also described how Superior approached internal challenges to introducing eClosings. Resistance to change was expected, but as the process became normalized, loan officers and title agents with the organization quickly embraced the experience of using DocMagic’s end-to-end eClosing platform—Total eClose™. The convenience of eClosings was particularly evident in remote online notarization (RON) closings, which enable all parties to attend closings virtually.

Faster, Smoother, And More Convenient eClosings

Electronic closings provided Superior customers and partners with newfound convenience, said Schroeder. Both experts noted that eClosings contributed to several ongoing benefits at Superior:

- Customers can choose to close remotely from their preferred location or opt for an in-person experience, using iPads provided by Superior for a digital workflow either way. The process, regardless of the customer's choice, is significantly streamlined, often reducing the closing time by up to 66%.

- eClosings empower customers by giving them the option to review documents in advance. The customers receive a link to the documents, allowing them to familiarize themselves with the details before the closing day.

- eClosings have often prevented closing delays, with customers being able to participate remotely in unexpected situations, ensuring smoother transactions.

- eClosings have boosted operational efficiency, enabling loan officers to attend more closings from their desks and enhancing their availability.

- Real estate agents and referral partners have responded enthusiastically since they can now attend multiple closings simultaneously without logistical constraints. This real-time engagement with clients has strengthened relationships and solidified partnerships.

Championing eClosing For Faster, More Efficient Mortgage Lending

The webinar concluded with both experts emphasizing the significance of champions within organizations—individuals who spearhead the eClosing adoption process.

The mortgage industry’s transformation through eClosings is a testament to the power of embracing technology. The journey to fully digitized mortgage closings pays off in increased efficiency, cost savings and enhanced customer relationships.

As the mortgage landscape continues to evolve, eClosings will remain a cornerstone of innovation and progress. For more information, watch the full webinar recording here.

Related Content:

Compliant IRS transcript requests: Adapting to changes in form 4506-C

The Internal Revenue Service (IRS) has recently implemented significant changes to the process of ordering tax transcripts and records, encouraging lenders to move from a manual ordering process to submissions that are Optical Character Recognition (OCR) compliant. As part of this modernization, the IRS has also introduced clean form requirements for the IRS Form 4506-C.

While this transition is expected to enhance efficiency, it’s essential for lenders to adapt their internal procedures for accurately collecting information on this form to prevent a) avoidable errors, b) subsequent rejection of transcript orders, and c) duplicate orders. Lenders must adapt their approach so that they remain in compliance as they submit IRS transcript requests and work alongside borrowers to ensure accurate tax return transcript information.

Top 4 Mistakes On IRS Transcript Request Forms

To ensure a smooth process and avoid rejection using the changed 4506-C, lenders must avoid the following prevalent errors when submitting this important request for an IRS transcript.

Below are some of the most common mistakes that cause form rejection.

1. Not using the updated form

The IRS updated their previous transcript form, the 4506-T, to the 4506-C at the end of 2022. Lenders are now required to use this new form, so ensure all agents have access to the October 2022 version of the form and use it exclusively for requests.

Vendors like DocMagic take care of this issue for you. We ensure you receive the right version of the necessary form based on updates from the IRS, making sure to follow updates as they occur and react accordingly.

2. Making simple errors

Unfortunately, small mistakes in filling out the form itself can result in rejection of your IRS transcript request. Among others, we’ve seen sections 5a and 5d missed or filled out incorrectly; various checkboxes left unchecked; and strikethroughs, circles and arrows used when they’re not allowed anywhere on the form (even if the borrower initials them to approve their use).

3. Using the incorrect address

It’s vital to double-check the borrower’s current address(es)—or, more accurately, their addresses listed in the loan file—in order to avoid rejection of your 4506-C. Check your records to ensure the addresses listed in the loan match this form perfectly.

4. Missing signatory checks or filling them out incorrectly

Last, always make sure the attestation box is checked when filling out this form. In addition, you must check the box that says “Signatory confirms document was electronically signed” if the form was electronically signed at any point.

Why The IRS Transcript Form 4506-C Is Important

It’s usually mandatory for lenders to have each borrower complete and sign a separate IRS Form 4506-C at or before closing, assuming their income is used to qualify for the loan (regardless of the income source). The only exception is when the borrower’s income has been validated by the Automated Underwriting System (AUS).

Both Fannie Mae and Freddie Mac require lenders to submit the IRS Form 4506-C for all loans reviewed under their post-closing quality control plan, except when transcripts are obtained during underwriting or when the borrower's income is validated by the AUS. Lenders should also be aware of the need for reverification of the borrower’s income and employment information.

Lenders should review and update their processes to incorporate thorough checks for errors on the IRS transcript Form 4506-C as part of their approval process. Staying vigilant and adhering to the revised requirements will help prevent transcript order rejections and ensure a compliant lending process.

To get more updates, contact us about our advanced compliance newsletter—the Compliance Edge.

Related Content:

DocMagic’s print fulfillment services continue to advance

DocMagic’s continuous advancement in print fulfillment services represents a significant development for our valued customers. Recently, we introduced Saturday printing and mailing services at no additional cost, offering a notable advantage to customers with paper disclosure requirements. This feature empowers our clients to expedite the loan process and cater to borrowers whose disclosures expire on a Saturday.

So, why do print fulfillment services remain an essential part of what DocMagic does to digitize the mortgage process? First, we’ll discuss why these services add necessary protections to loan workflows—for both lenders and borrowers.

Why Print Fulfillment Services Are So Essential for Lenders (Even In A Digital Workflow)

When borrowers don’t sign the electronic versions of disclosures in time—or when, for a variety of reasons, they don’t consent to eSign itself within required timeframes—lenders are at risk of compliance violations.

To help keep lenders compliant, print fulfillment services may include any of the following tasks:

- Preparing, mailing, and delivering paper copies of initial disclosures to borrowers in accordance with compliance standards.

- Reporting document delivery to provide lenders with peace of mind regarding meeting deadlines.

- Automating document delivery and minimizing human intervention to ensure borrower privacy.

Printing loan documents quickly is important because it helps to expedite the overall loan process, meet the needs of lenders and borrowers, and most importantly, shield the lender from any compliance issues related to late delivery of certain documents.

By offering continually faster print fulfillment services, we’re helping to provide customers with greater flexibility and immediacy in the processing of their borrowers’ loan documents.

DocMagic’s Innovative Print Fulfillment Services

To support our commitment to fast and compliant print fulfillment, we now allow customers to print and mail packages on Saturdays.

We’ve enabled this feature so that eSign packages scheduled to expire on Saturday will now be printed and mailed on Saturday, rather than printed and mailed on Friday, allowing borrowers who need a bit more time to eSign their loan documents to do so. This feature works in tandem with our customers’ existing workflow customizations: for example, if a lender is closed on Saturday or has specific rules for fulfillment within their account, the new Saturday fulfillment feature will not override any of those customizations. In addition, documents will still be printed and mailed on Friday if an observed holiday falls directly on Saturday.

The flexibility and immediacy of these print and mail services are made possible by DocMagic’s state-of-the-art Print Fulfillment Center and integrated into our completely automated print fulfillment process. By making it possible for specific document packages to print on Saturdays, we’ve given customers the option to accelerate the loan process even further and to accommodate borrowers who need immediate delivery of their loan documents.

All these print advancements are automatically available to DocMagic customers, at no additional cost, without any need for user action.

And for an additional cost, our customers can even order rush same-day print and mail services Monday through Saturday.

By leveraging the latest technology and automating the print fulfillment process, DocMagic has demonstrated its commitment to providing innovative solutions that meet the evolving needs of its customers. In offering innovative solutions like Saturday and rush print fulfillment services, DocMagic is helping its customers to meet these goals and stay ahead of the competition.

For any inquiries or comments regarding Saturday print fulfillment, customers can contact techsupport@docmagic.com.

Related Content:

Compliance Newsletter - August 2023

MPA honors Leah Sommerville of DocMagic with 2023 Elite Women Award

We're proud to announce that Leah Sommerville, a senior account executive and key member of our eClosing Team, earned a spot on this year’s prestigious Elite Women in Mortgage list published by Mortgage Professional America (MPA).

About The Elite Women Award

The annually-produced award highlights 50 female leaders who are making a difference and driving positive change within the mortgage industry. MPA says the winners represent a league of influential women who go above and beyond for their companies and the industry, exhibit a genuine passion for their craft, have significant accomplishments from the last 12 months, and possess unwavering determination.

“Leah’s expertise in eClosings is instrumental in guaranteeing the success of every client who chooses to embrace a paperless closing process,” stated Dominic Iannitti, president and CEO of DocMagic. “We commend Leah for her continuous dedication and are thrilled that MPA has honored her outstanding achievements with the prestigious Elite Women distinction.”

Leah Sommerville's eClosing And Mortgage Expertise

As a valued member of DocMagic's team of eClosing specialists, Sommerville is committed to assisting lenders in tailoring an optimal digital mortgage strategy to their unique business needs. Since joining the team in 2018, she has guided numerous lender clients through the transformation from paper processes to the cutting-edge realm of digital mortgages, creating a wave of efficiency and innovation.

“I’m honored to accept the 2023 Elite Women award from MPA and I thank the judges for recognizing my efforts,” stated Sommerville. “The industry has come a long way since introducing eClosings and I look forward to introducing some of the new digital mortgage innovations that DocMagic is developing.”

Notable achievements Sommerville has been a part of in the last 12 months include her involvement in the rollout of DocMagic's new eNotary onboarding program for a national database of notaries, enabling those notaries to attain RON certification on DocMagic’s Total eClose™ platform. Her efforts have helped train hundreds of notaries on how to effectively complete remote online notarization of loan documents with borrowers.

Sommerville also shepherded numerous lenders and secondary market participants through the MERS eRegistry membership process to start producing eNotes and subsequently store them in a secure eVault—guidance that enhances lender ROI, improves liquidity, and moves the industry toward going fully paperless.

In addition, Sommerville helped introduce DocMagic’s e-Eligibility tool, eDecision,™ that audits loans and confirms the type of eClosing that can be compliantly executed. Also notable is that Sommerville closed out 2022 exceeding her sales goal by 65 percent, which she accomplished in a down market despite a steep drop in loan volume.

Currently, Sommerville continues to press on, providing a consultative, hands-on approach to lenders for eClosings, working with industry eClosing partners, and speaking at conferences and events on the topic of digital mortgage automation.

The complete list of 2023 Elite Women winners can be found on MPA’s website.

Related Content:

DocMagic and Finastra announce integration to transform closings

As the leader in fully-compliant loan document generation and comprehensive eMortgage services, today, we’re proud to announce the integration of our leading-edge Total eClose™ platform with Finastra's MortgagebotLOS solution, enabling an enhanced customer experience for mortgage borrowers.

Dominic Iannitti, president and CEO of DocMagic, said, "We've demonstrated the power of Total eClose through our integration with Finastra's MortgagebotLOS, creating an innovative automation tool for every eClosing originated through the solution. This collaboration not only saves time and effort, but also amplifies secondary market potential, eliminates laborious manual tasks, slashes cost per loan, and streamlines the closing process."

About Mortgagebot And Total eClose Together

Through this integration, Finastra MortgagebotLOS lenders gain access to DocMagic's comprehensive suite of eClosing tools for all loans. Powered by a robust, bi-directional document flow, the tracking in MortgagebotLOS can connect instantly to DocMagic’s Total eClose.

This seamless integration combines comprehensive eClosing technology with data-driven origination workflow automation that generates compliant loan documents, facilitates borrower eSignatures, and enables remote online notarizations (RON). Additionally, Total eClose empowers Finastra users to effortlessly generate eNotes, establish direct connections with the MERS eRegistry, and securely store documents in a certified eVault.

Why integrate mortgage LOS systems with eClosing systems?

"The integration of Total eClose into MortgagebotLOS offers new tools to enhance the customer experience," said MaryKay Theriault, director of product management at Finastra. "We're thrilled to offer our clients the efficiencies and conveniences that this partnership brings. Together, we're setting new industry standards and making the mortgage closing process easier and more streamlined for borrowers across the United States."

Finastra’s MortgagebotLOS is a feature-rich, end-to-end, web-based mortgage lending platform that supports retail, wholesale, and correspondent business channels. Widely recognized for streamlining the origination process and reducing operating costs, MortgagebotLOS is trusted by over 1,400 clients nationwide to accelerate mortgage lending.

In addition, DocMagic's highly acclaimed Total eClose solution has evolved the mortgage closing process by providing a secure, streamlined, and fully paperless digital environment delivered as an all-in-one application. The system automates essential tasks, from document generation to eClosing and eNotarization, ensuring a superior user experience for borrowers and other participants.

For DocMagic and Finastra customers, these two revolutionary products are now stronger together. This integration is just one step toward our mission to revolutionize the mortgage industry through powerful digital products.

Related Content:

MISMO seeks comments on VA form & David Garrett speaks on MISMO

The Mortgage Industry Standards Maintenance Organization (MISMO)—the forerunning body deciding on operational standards for the real estate industry—is in the midst of a public comment stage for a new standard to be released involving a U.S. Department of Veterans Affairs (VA) loan form. This stage is an essential part of MISMO’s goal to increase consensus within the mortgage industry.

Although following MISMO standards is voluntary, it has the potential to help lenders cut processing costs, increase transparency and pass savings to their borrowers.

We’re familiar with MISMO’s deep involvement in the mortgage industry because of our working relationship with MISMO’s groups dedicated to standard development, also called “communities of practice” (CoP). In fact, DocMagic’s own Integration Services Manager, David Garrett, is currently a vice chair of the MISMO Origination CoP and regularly meets with other mortgage experts to develop clear standards for mortgage origination.

Overall, MISMO standards are essential to a functioning real estate economy, and their current call for public comment is a testament to the organization’s dedication to efficiency in homebuying.

How MISMO Mortgage Standards Are Developed And Used

To offer some background on MISMO standards and why they’re created, we spoke to David about the importance of these efforts and his role in a MISMO CoP.

1. What are MISMO mortgage standards?

First, a definition: MISMO mortgage standards are specifications that can be followed voluntarily by technology providers, lenders, and other mortgage organizations as they build technology and create their own data-sharing policies.

These specifications are essential for transferring accurate mortgage-related data between various trading partners, such as lenders, GSEs, document providers and servicers.

2. Why are MISMO standards created?

MISMO mortgage standards are created so that different vendors’ platforms work together and speak the same operational language. MISMO’s ultimate goal is interoperability: cohesion within the mortgage space; cohesion while transferring data between borrowers, lenders and GSEs; and cohesion between the vendors that support the industry.

David describes perfect MISMO standard adherence as a point at which everyone shares the same basic structures and data naming conventions. If one lender sends a "loan amount," another sends a "base loan amount," and yet another sends an "original loan amount," but they're really all the same thing, it would be less confusing for all parties to agree on calling the same data point a “loan amount.”

3. What are CoPs, and what do they do?

MISMO CoPs and committee members play a significant role in shaping new standards and offering recommended approaches for important initiatives. These initiatives could include origination technologies, remote online notarizations, digital mortgages, closing instructions, blockchain technology, and various other areas.

For example: the Origination CoP, of which David is a member, focuses specifically on the entire origination process and the main subcategories within it of underwriting, application, and closing.

4. How are standards used?

Adherence to these standards is, for the most part, voluntary. But lenders can take note of which vendors and partners are MISMO-compliant to ensure that the data from (or inside) one platform will always work with another (DocMagic’s Total eClose platform, for example, generates a MISMO Category 1 SMART Doc eNote that is 100% MISMO-compliant).

Most importantly, this type of standard is essential for technology vendors, lenders and mortgage professionals to follow so they can provide the most accurate and efficient homebuying process to borrowers across the nation.

The Ongoing MISMO Request For Public Comment

The current public comment phase is a perfect time to see MISMO standardization in action. As of today, MISMO is in the midst of a call for public comment on a new dataset created for the information that goes in the VA Verification of Benefits form (Form 26-8937).

MISMO members worked with the VA to develop this valuable standard for relaying the information on this form so that borrowers involved with the VA can enjoy a convenient homebuying process.

Organizations that could have intellectual property tied to this form or this dataset are encouraged to contact MISMO. Interested parties have a 30-day period, ending on July 6, 2023, to provide comments and disclose any relevant patent rights using info@mismo.org.

About MISMO As An Organization

Many regulators, housing agencies and GSEs require organizations to abide by MISMO standards. This creates standardization and efficiency throughout the national mortgage industry.

MISMO fosters extensive collaboration within the industry to establish standards that effectively address the most challenging business problems in housing finance, leading to cost reductions, enhanced transparency and improved overall efficiency.

And best of all, MISMO welcomes all participants to become members, including lenders, banks, credit unions, servicers, third-party vendors, software companies and individuals. In the end, MISMO takes an open approach to sharing knowledge and standards so that the mortgage industry as a whole can benefit and grow.