Compliance Newsletter - February 2020

Leveraging Mobile Technology to Ramp Up the Borrower Experience

Mortgage News Network Interview Live at MBA Annual 2019

Ron Carrillo shares how the new LoanMagic® App gamifies the borrower's process for providing critical information while helping lenders reap the benefits of going digital one step at a time.

Source: Mortgage News Network

Compliance Newsletter - January 2020

A Document Library of 200,000 Forms and Counting!

DocMagic is the Document Preparation market share leader, with 37.6 percent of the market comprised of banks, credit unions, and independent mortgage bankers according to STRATMOR Group’s 2019 Technology Insight Study.

A Document Library of 200,000 Forms and Counting!

DocMagic's massive Document Library is comprised of compliant forms and documents that meet almost every customer and industry need. By combining our Document Library with several different form-generation technologies we have developed and perfected in our 30+ years, we can implement forms and documents so that they behave identically throughout all the solutions we provide to our clients.

How do we maintain such a large Document Library?

Since 1987, we have amassed a library of over 200,000 compliant forms and documents ready to be implemented for our customers. These documents include thousands of existing forms along with the many forms we customize to fit a client’s specific needs. As we update and customize forms, we preserve all iterations of form changes that have been implemented so they're ready to be re-used as needed.

With such a large number of forms, we’ve even developed an in-house tool—our Forms Analyzer—that indexes form content to make search queries for specific content. This allows us to quickly determine whether or not a customer will need an existing form or if they require us to customize a form for their specific use. We'd be surprised to see a document generation solution with a larger and more organized archive then we have today.

Keeping forms and documents compliant

Our years of experience in the industry have given us the time to develop a very efficient process to develop and release compliant documents and forms into production.

- We use our Forms Analyzer to search through our document library and determine whether the form you need is a custom form or an existing form.

- Then we determine whether the template and/or programming of that form needs to be modified for your specific use.

- If a template needs to be updated, it is sent to our Forms Layout Team where they make the necessary changes before passing the work onto our Forms Programming Team.

- If just the programming needs to be updated, the template is sent directly to Forms Programming where it's tested for performance assurance.

- Forms programming then releases the form for further testing by our internal teams and/or the customer to ensure quality and complete satisfaction.

- Once approved, Forms Programming will release the form into production for customer use.

All the forms in our standard library are backed by our reps and warrants to protect our customers. From Model Forms to Custom Forms—the Compliance Team meticulously scrutinizes all forms to ensure compliance with current mortgage laws and regulations.

Forms flexible enough to fit our client's needs

Our processes for generating custom forms allow us the flexibility to handle specific requests from our customers. DocMagic can support your needs quickly and compliantly with:

- Static templates

- Fully dynamic templates (like the Loan Estimate or Closing Disclosure)

- Hybrid forms

- Forms in full color

- Real signature images

- Logo customization

- And more...

Choose the industry leader in Document Generation! Schedule a Demo today.

DocMagic Leads eClosing Categories and Holds Highest Market Share in Document Generation in STRATMOR Group’s 2019 Study

TORRANCE, Calif., Nov. 5, 2019—DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced that its Total eClose™ platform is the eClosing leader based on market share, overall satisfaction and lender loyalty in STRATMOR Group’s 2019 Mortgage Technology Insight Study.

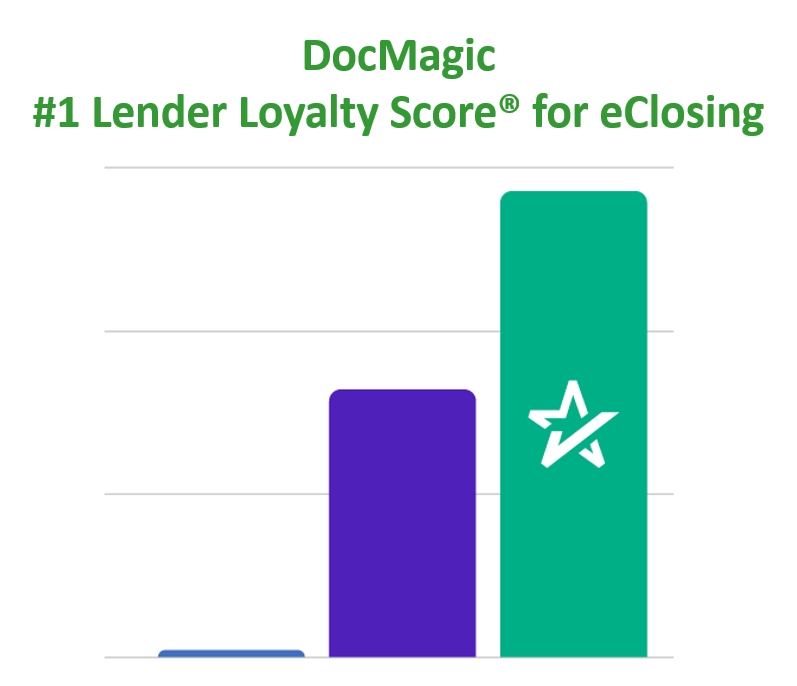

“STRATMOR’s study places DocMagic as the eClosing leader, with more than 52.4 percent of the market comprised of banks, credit unions, and independent mortgage bankers,” said Dominic Iannitti, president and CEO of DocMagic. “We’re thrilled to have our customers rank us so highly in a study by an organization as reliable and respected as STRATMOR.”

DocMagic also led eClosing providers in overall satisfaction ratings and STRATMOR’s coveted Lender Loyalty Score® analysis, which the study states is based on lender satisfaction and intent to continue using the technology.

A second DocMagic technology, the company’s document generation solution, also holds the highest market share in its category. Together, Total eClose and DocMagic’s dynamic document generation can provide lenders with 100 percent paperless eClosings.

According to STRATMOR Group, this year’s study was based on responses from 250 mortgage professionals representing 209 unique lenders. The 2019 survey represents 29 percent of the mortgage market and draws in part upon 2017 HMDA data to maximize accuracy. STRATMOR defines eClosing technology as a system that allows lenders to deliver fully digital and also hybrid eClosings through a central platform. STRATMOR concluded that “eClosing represents a significant ROI opportunity for lenders to automate.”

DocMagic’s Total eClose platform is a comprehensive solution that delivers a completely paperless workflow and seamlessly integrates every component of the closing process. It includes a robust eDocument library with integrated eSign technology; the MISMO Category One SMARTDoc® eNote; eNotary technology for all 50 states; direct connectivity to the MERS® eRegistry; GSE-certified eVault storage for one year; secure and compliant investor delivery; and a complete audit trail for proof of compliance.

Persons interested in learning more about the industry’s leading eClosing platform can contact sales@docmagic.com.

About STRATMOR Group:

Founded in 1985, STRATMOR Group has, since inception, focused exclusively on making the mortgage business better for lenders and the borrowers they serve. Today, STRATMOR is a data-driven advisory that guides lenders and vendor clients alike to make smart strategic decisions, solve complex challenges, streamline operations, improve profitability and accelerate growth. For more information, visit https://www.stratmorgroup.com/.

Compliance Newsletter - November 2019

Compliance Newsletter - November 2019

New DocMagic Mobile App to Fill Critical Gap in Lending Workflow

TORRANCE, Calif., October 16, 2019—DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced the launch of its new LoanMagic mobile application. LoanMagic, which is provided free to all DocMagic customers, leverages a powerful backend platform that provides full interoperability with DocMagic solutions, as well as other third party mortgage software.

LoanMagic™ is provided free to customers as part of DocMagic’s strategy to increase adoption of digital lending.

“Bringing mobile functionality to borrowers and enabling lenders to connect with their customers is the end goal of most mobile applications in our industry—but at DocMagic, it is just the beginning,” says Dominic Iannitti, president and CEO of DocMagic. “LoanMagic isn’t an add-on. It’s a fully interoperable technology that fills a critical gap in the digital mortgage process. It is just as powerful as any of our flagship and award-winning technology.”LoanMagic is an intelligent, intuitive mobile application that provides a quick, easy and transparent way for borrowers to stay fully engaged with their loans—and lenders—throughout the mortgage cycle. Its core functionality includes real-time loan status, document uploads, eSigning, integrated messaging, task management, push notifications and more. LoanMagic leverages DocMagic’s eVault to ensure that every transaction is logged and securely stored, and it uses a “gamified” design that encourages borrower engagement by making the process of fulfilling conditions faster, easier and more entertaining for the borrower.

LoanMagic’s primary differentiator is at its back end, which allows the mobile app to provide an unprecedented level of interoperability with numerous relevant technologies, ranging from DocMagic’s solutions to point-of-sale systems (POS), loan origination systems (LOS), borrower-facing applications, closing solutions, various settlement services technology, document scanning, cloud storage tools and others.

“A truly digital mortgage offers a continuous, fluid experience for everyone. The lender should not be patching holes or bridging gaps,” says Iannitti. “With LoanMagic, there’s no data degradation, no delay, no added steps lenders need to take to make up for the use of a mobile application, like they may have experienced with other mobile applications in the past. LoanMagic feels and acts like an organic part of the technologies it supports. That’s imperative for a truly digital mortgage experience.”

LoanMagic eliminates many of the issues that have traditionally caused delays in the mortgage process. The result is greater transparency and visibility, lower cost to produce loans, assurance of compliance and elimination of surprise issues that create delays at the closing table. DocMagic provides LoanMagic at no additional cost to its customers as part of its mission to increase digital mortgage adoption, broaden collaboration among the numerous disparate entities involved in a mortgage, and advance interoperability between systems across the supply chain.

Learn more about LoanMagic or see a demo by contacting sales@docmagic.com or visiting www.docmagic.com/loanmagic. In addition, DocMagic will offer demonstrations of LoanMagic in booth #407 at the MBA Annual Convention & Expo in Austin, Texas from Oct. 27 - 29.