DocMagic’s Leah Sommerville wins inaugural NextGen Leader Award

Leah Sommerville, DocMagic’s senior account executive, has been named one of 10 winners of the NextGen Leader Award by PROGRESS in Lending Association. This award is specifically for people who have been in the industry for 10 years or less.

“We need new leaders that are not afraid to step forward and blaze a new trail. We need creativity. We need bold new ideas,” PROGRESS in Lending stated in announcing the award.

Sommerville is a member of DocMagic’s eClosing Team, where she has helped numerous lenders form their digital mortgage strategy and implement eClosings. She's no stranger to accolades — last year Sommerville was named one of National Mortgage Professional magazine’s Top 40 Under 40 Most Influential Mortgage Professionals. She's also a respected thought leader in the lending space.

“Being named to this new list of industry professionals who are all striving to make a difference is truly an honor,” she said. “At the end of the day, working for an industry-leading company like DocMagic that is constantly innovating makes it easy to get excited and passionate about introducing digital mortgage solutions to lenders.”

In 2020, DocMagic achieved 128% year-over-year growth and executed the most eClosings in company history, tallying a 724% increase in transactions via its Total eClose platform.

Sommerville has forged numerous partnerships between lenders, settlement agents, attorneys, notaries, investors, warehouse lenders and others in order to further digital mortgage initiatives that benefit the entire supply chain. She has also worked closely with leading loan origination system (LOS) vendors, settlement providers and third-party systems to facilitate automation of the entire eClose process. Her efforts have helped execute thousands of eClosings and increased eClosing adoption among relevant organizations by over 1,000%.

Related Content:

Number of title agents who conducted eClosings rose in 2020 — but some still resist

The number of title agents who said they conducted eClosings in 2020 more than doubled from the year before, according to a new survey.

The 11th annual Voice of the Title Agent report, produced by The Title Report, found that 2020 was a profitable year for title agents, in spite of the pandemic. Nine out of 10 said their business improved in 2020, up from 80% who reported that the previous year.

During the pandemic, technology — in particular eClosings — became more essential for title agents to perform their job duties. The percentage who said they are already conducting eClosings went up by more than 114% from last year, while those who said they completed more eClosings in 2020 than in the year prior rose 150%.

One survey respondent said the pandemic will result in a permanent change to the title industry: “There will be a ‘real estate pre-COVID’ and a ‘real estate post-COVID.’ I doubt that the old way of doing business with bricks and mortar will come back. ... Remote online closings are becoming much more common.”

About 20% of respondents said they don’t expect to use eClosings at all — down from 25% who said the same last year. Here’s a sample of their reasons as to why eClosings are a no-go for them:

- Potential fraud: “I do not intend to do eClosings. I feel that they just open the door to liability and claims of fraud.”

- Technology: “I’m set up, but the software is so awful that I stopped.”

- Resistance to change: “I like ink, and I will not lie, and neither does ink! Sorry, been at this for 39 years. I will quit before I do eSigning, especially loan docs, and I will not remote online notary.”

Meanwhile, other agents said that while they’re ready for eClosing, their partners are not. “We are ready and capable, but lenders are not,” one agent said. Another said, “We just need lenders to get there.”

Interestingly, many lenders looking to start the eClosing process have found that a common roadblock is getting their business partners — including title agents — on board.

Leah Sommerville, a senior account executive at DocMagic, said that as she helps lenders get onboarded with eClosings, she’s finding that more and more settlement agents are already familiar with the eSigning process. Some are even including eSigning or eNotarization in their internal processes.

“It’s such a relief for lenders when settlement agents are already comfortable with the eSigning process,” she said. “As lenders consider their successful eClosing adoption, this eliminates a large concern for them.”

DocMagic’s eClosing solution includes a settlement agent portal where agents can conduct a variety of functions as part of the closing event, including adding additional participants (e.g. sellers and witnesses); adding and e-enabling title documents; reviewing closing documents to ensure all acknowledgeable annotations are present prior to eClosing; and selecting the preferred eNotary provider and eNotarization method (“in person” or “remote online”).

Additionally, lenders often think they have to train and onboard settlement agents themselves, but Sommerville notes that for clients, DocMagic will handle the settlement agent onboarding process on lenders’ behalf.

Despite some pockets of resistance, the survey and responses show that most title agents realize that eClosings are where the mortgage industry is heading.

“Digital closings represent a small percentage of our business today,” one said. “However, I expect them to trend up and that they’ll become a consumer expectation over time, not unlike what we’ve seen in other lines of insurance.”

Related Content:

DocMagic client Truliant transfers FHLBank Atlanta’s first eNote

North Carolina-based Truliant Federal Credit Union has become the first lender to transfer an eNote, or electronic promissory note, to FHLBank Atlanta. The move marks one of the first successful eNote transfers within the 11-member Federal Home Loan Bank system.

“This is the culmination of years of work by the state of North Carolina, FHLBank Atlanta and a dedicated team at Truliant,” said Todd Hall, Truliant’s president and CEO. “This final digital step makes the whole homebuying experience quicker, more accurate and secure.”

The transfer was conducted as part of FHLBank Atlanta’s eNote pilot program, meant to test the bank’s infrastructure and ensure that more lenders can report eNotes as collateral. Truliant, which serves more than 270,000 members at over 30 locations across the Carolinas and Virginia, was invited to participate in the pilot.

Learn why eNotes are a game changer for the mortgage industry

“Interest in the ability to pledge eNotes as collateral continues to grow among our members and this initial transfer demonstrates that we now have the ability to meet this growing demand,” said Rob Kovach, FHLBank Atlanta’s Chief Credit Officer.

Truliant completed the eNote transfer on March 26 using the MERS eDelivery system and DocMagic’s eVault — almost exactly a year after they completed their first end-to-end eClosing on March 27, 2020, via DocMagic’s 100% paperless Total eClose solution.

To conduct the transfer Truliant had to meet a series of standards set by the FHLBank system relating to eSignatures, eNote documentation, eRegistry requirements, eVaults and more. For example, the standards covered what processes Truliant has in place if the eNote should need to be modified or papered out, or if a loan goes into foreclosure, said Beth Eller, Truliant’s vice president of mortgage services.

“We had eNotes in our portfolio so we had the ability to collateralize a note with them,” Eller said. “FHLBank Atlanta is a great institution. We were just really honored to be asked to participate.”

eNote usage is skyrocketing. In 2020, there were 462,671 eNotes registered on the MERS eRegistry, which shattered the 2019 record of 127,178 eNotes.

The individual members of the FHLBanks, the majority of which selected DocMagic’s eVault technology, are in disparate stages of accepting eNotes as collateral. FHLB Des Moines is the only other member to have completed an eNote transfer, while Chicago and Dallas announced in mid-2020 that they would begin accepting eNotes. Other members are still in various planning stages.

In 2020, Truliant became the first credit union and second financial institution based in North Carolina to offer full eClosings.

“DocMagic was critical to our success and in being able to do eClosings,” Eller said. “Without DocMagic’s help, we would have really struggled to get eNote adoption as quickly and efficiently as we did. It’s been a real plus to have a partner that is engaged in your success and that really has a vested interest in making sure that things go well.”

Related Content:

CFPB rescinds 7 pandemic-related policy statements

The Consumer Financial Protection Bureau has announced that it is rescinding seven policy statements that were issued last year to assist financial institutions during the height of the pandemic. Issued between March 26 and June 3, 2020, the policy statements provided some flexibility in complying with certain regulatory filings and consumer finance laws.

The rescission date for the policy statements was April 1, 2021. The CFPB stated in each policy rescission that it would not be providing a notice and comment period as it would with rulemaking. The statements are intended to provide information regarding the CFPB’s plans to exercise its supervisory and enforcement discretion, which does not impose any change to existing legal requirements.

The rescinded policy statements include:

- March 26, 2020: Statement on Bureau Supervisory and Enforcement Response to COVID-19 Pandemic. The statement provided that the CFPB would look at good-faith efforts to assist consumers while taking into consideration staffing and related resource challenges related to the pandemic.

- March 26, 2020: Statement on Supervisory and Enforcement Practices Regarding Quarterly Reporting Under the Home Mortgage Disclosure Act. The statement provided that until further notice, the CFPB would not bring an action for failure to report HMDA data quarterly as required. The rescission states that financial institutions must resume quarterly HMDA data submissions starting with 2021 first quarter data.

- March 26, 2020: Statement on Supervisory and Enforcement Practices Regarding CFPB Information Collections for Credit Card and Prepaid Account Issuers. The rescission statement provides guidance on how supervised entities should follow information collections requirements for credit card and prepaid accounts.

- April 1, 2020: Statement on Supervisory and Enforcement Practices Regarding the Fair Credit Reporting Act and Regulation V in Light of the CARES Act. The rescission statement advises the CFPB will resume full supervisory and enforcement activity, but still encourages financial institutions to provide and report payment relief actions.

- April 27, 2020: Statement on Supervisory and Enforcement Practices Regarding Certain Filing Requirements Under the Interstate Land Sales Full Disclosure Act (ILSA) and Regulation J. The rescission ends flexibility provided to land developers and other entities subject to ILSA related to filing annual reports and financial statements.

- May 13, 2020: Statement on Supervisory and Enforcement Practices Regarding Regulation Z Billing Error Resolution Timeframes in Light of the COVID-19 Pandemic. The rescission ends flexibility of enforcement for the handling of consumer dispute requests by financial services entities.

- June 3, 2020: Statement on Supervisory Enforcement Practices Regarding Electronic Credit Card Disclosures in Light of the COVID-19 Pandemic. The statement provided that the CFPB would not cite a violation or bring an enforcement action if an issuer did not obtain oral consent for certain electronic disclosures. As financial institutions have now had time to improve operations and servicing procedures, the CFPB will no longer provide flexibility in enforcement of TILA and Regulation Z violations.

Additionally, the CFPB released Bulletin 2021-01 on March 31, 2021, which rescinds and replaces Bulletin 2018-01, issued on Sept. 25, 2018. The new Bulletin announced that the CFPB will no longer issue formal written Supervisory Recommendations. Instead, examiners will issue Matters Requiring Attention (MRAs) to express expectations to supervised entities, with or without a related finding of a violation. The MRAs should include specific goals and corrective actions to be taken, along with a specific timeline for actions.

Related Content:

Compliance Newsletter - April 2021

What is data validation and why is it so important?

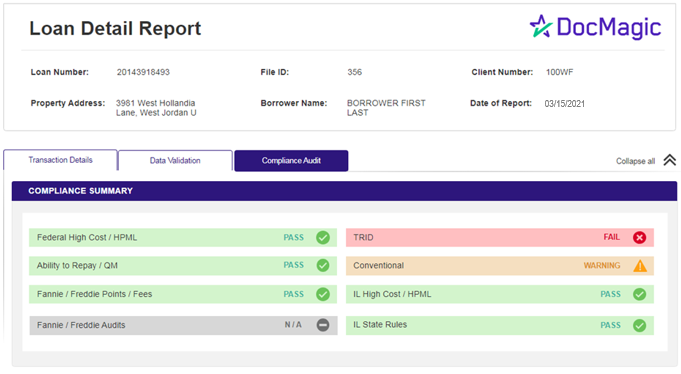

The first step of a closing is for a massive amount of information — about the borrower, the property and the type of loan — to be entered into the lender’s loan origination system (LOS). Data validation is the process by which that information is audited and verified.

Good data validation is crucial. For a variety of reasons (such as how the data is received, the size of the required data set and the complexity of the information), information may be incomplete, incorrect or improperly formatted — potentially causing major disruptions for lenders later on in the process. Lenders need a data validation system that confirms the loan data they’re collecting is complete, accurate and compliant at the state, federal and investor level.

Good data validation is crucial. For a variety of reasons (such as how the data is received, the size of the required data set and the complexity of the information), information may be incomplete, incorrect or improperly formatted — potentially causing major disruptions for lenders later on in the process. Lenders need a data validation system that confirms the loan data they’re collecting is complete, accurate and compliant at the state, federal and investor level.

“It’s a health integrity check of all of the loan’s data, to ensure that you have a complete and accurate data set prior to a document generation event,” said Chris Lewis, DocMagic’s Director of Enterprise Solutions.

What makes for a strong data validation system?An effective data validation system should be able to analyze this data as it’s being submitted in order to catch errors and inconsistencies, such as if the zip code doesn’t match the state or if information such as the interest rate is missing, to name a few.

The best data validation systems should have a multilayered error-detection program, such as an audit engine that’s constantly analyzing the loan data. In addition to that, the system should generate a loan report that highlights any inaccurate, missing or questionable information. At the touch of a button, lenders should be able to pull up a laundry list of any issues that need to be addressed.

Of course, even if they lack an audit engine or loan report, lenders could still start plugging data into their LOS and generate a document package — but it's much more likely this would result in errors they won’t spot until much later.

“Maybe it’ll have an unpopulated field or generate documents in a non-compliant way,” Lewis said. “The old way is where lenders would generate documents and then look at them and realize, ‘I still need to add this or that,’ instead of being able to ensure everything is correct beforehand. Lenders could generate documents that way, but it would take a lot longer and be a lot more error prone.”

As part of data validation for both its document generation and 100% paperless Total eClose solutions, DocMagic offers an audit engine and Loan Detail Report that guarantees lenders can generate compliant document packages. The Loan Detail Report can be provided in both XML and browser-ready HTML formats.

On top of that, DocMagic also offers lenders the ability to configure custom audits according to their needs (for example, to flag things such as if a property in a specific zip code is over a certain price threshold). Additionally, after over 30+ years of operation and millions of closings, DocMagic has developed thousands of prebuilt audits that instantly spot potentially questionable data.

“Lenders are doing all the legwork to do their best to get complete and accurate data into the documents they generate, but using an automated data audit and validation engine can greatly reduce errors and double as a quick way to know what data you have left to collect,” Lewis said. “DocMagic’s platform gives lenders the benefit of all these other loans that have been closed in a compliant way on our platform, and of us providing rulesets that ensure they’re collecting quality data. That’s the endgame: quality data that’s complete.”

Related Content:

Survey: Almost 40% of millennials would buy home online

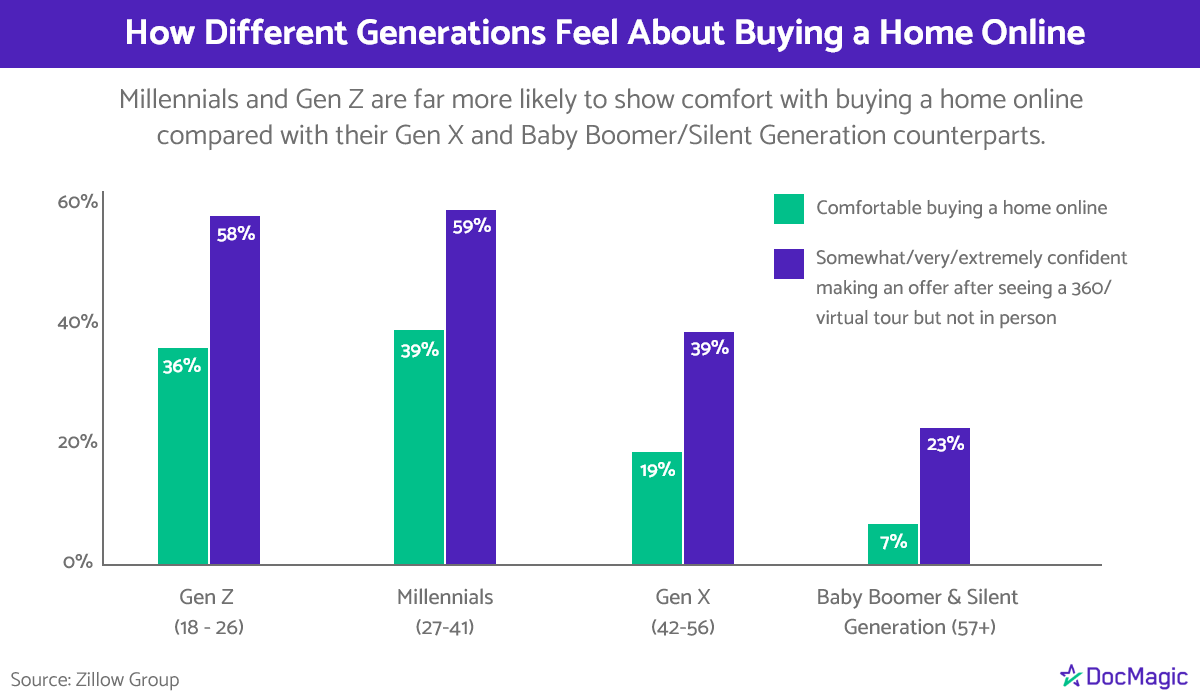

Millennials are much more likely than other generations to say they would be comfortable buying a home online — and their younger Gen Z counterparts aren’t far behind, according to a new Zillow survey.

When asked how comfortable they would be buying a home online, 39% of millennials (ages 27-41) and 36% of Gen Z, aka “Zoomers” (ages 18-26), answered affirmatively, compared with just 19% of Gen X (ages 42-56) and 7% of Baby Boomers and the Silent Generation (ages 57 and older). Across all groups, 23% of respondents responded positively, the survey found.

“It’s clear that strong demand from the next generation of buyers will keep real estate technology in place long after the pandemic is over,” Zillow Senior Vice President of Product Matt Daimler said in a statement. “Digital tools rapidly adopted during the pandemic not only make home shopping safer, they make it faster and easier. … Many transactions can now close remotely, too, saving time and hassle."

Numbers were even higher when respondents were asked how confident they’d be making an offer on a home after touring it virtually, without having stepped foot in it. A majority of Gen Z (58%) and millennials (59%) said they were “somewhat/very/extremely confident,” while 39% of Gen X and 23% of the Baby Boomer/Silent Generation respondents said the same.

Millennials, the largest generational group in the country, have made up the largest share of homebuyers since 2014. They continue that streak at 37%, according to the National Association of Realtors’ 2021 Home Buyer and Seller Generational Trends report, which also found that 82% of younger millennials and 48% of older millennials were first-time homebuyers — more than any other age group.

With a huge number of millennials hitting their mid-to-late 30s (the typical age of a first-time homebuyer is 34), Zillow estimates there will be 6.4 million more households formed by 2025, driving housing demand for years to come.

The data clearly shows millennials both dominating the homebuying market and eager to use online tools for the home search and buying process, including virtual tours and interactive floor plans that allow them to shop from their couch.

These current and future customers will no doubt also expect a digital mortgage experience, including the ability to track their loans on mobile apps and a 100% remote closing process. Lenders should prepare for this incoming wave now.

Related Content:

DocMagic, Secure Insight partner to create national eNotary training program

DocMagic is teaming up with New Jersey-based Secure Insight to set up a training program on remote online notarization (RON) technology and processes. The move will establish a database of notaries who have been fully trained and certified on DocMagic’s industry-leading, 100% paperless Total eClose platform. The partnership combines DocMagic’s technology and Secure Insight’s unique database and individual training for notaries.

Amid rising demand for digital closings, lenders have a growing need to tap well-qualified eNotarization professionals who can ensure deals close smoothly and on time. This new certification program, which reaches the greatest number of notaries with a working knowledge of Total eClose, is poised to significantly move the adoption needle.

"Ultimately, this partnership creates a better RON process for lenders and borrowers alike, benefiting all users involved in the eClosing process," says Dominic Iannitti, president and CEO of DocMagic. "Lenders are operating at maximum capacity right now with an influx of mortgage applications that they must ultimately close on as efficiently as possible amid heavy loan volume. Our new certification process will ensure lenders that RON eClosings will be handled quickly and efficiently by a ready supply of proficient eNotaries.”

Secure Insight’s extensive national notary database can now be easily accessed to find notaries who are qualified to complete seamless, compliant eClosings using RON technology.

"One of the primary challenges in facilitating RON transactions is that lenders are hesitant to entrust the closing process with a notary that may be ill-equipped to effectively perform an eClose transaction," says Andrew Liput, CEO at Secure Insight. "Teaming with DocMagic allows us to identify properly licensed, experienced and trained professionals whom lenders will feel comfortable leveraging to perform the specialized functions surrounding these unique transactions.”

Related Content:

DocMagic named to HousingWire's Tech100 list for 8th straight year

DocMagic has been named to HousingWire’s 2021 Tech100 Mortgage list, which recognizes the mortgage industry’s most innovative and impactful companies.

HousingWire noted that this year’s winners are revolutionizing the mortgage process.

HousingWire noted that this year’s winners are revolutionizing the mortgage process.

“After the uncertainty and unpredictability of last year, we expected a greater adoption of technology. However, these 100 real estate and mortgage companies took digital disruption to a whole new level and propelled a complete digital revolution, leaving a digital legacy that will impact borrowers, clients, and companies for years to come,” said Brena Nath, HousingWire’s HW+ Managing Editor.

DocMagic had a record year in 2020, achieving 128% growth over 2019 and helping more than 130 lending institutions successfully implement eClosing strategies and solutions amid a pandemic and an unprecedentedly high-volume lending landscape. Demand spiked for DocMagic’s eClosing solutions, particularly its award-winning 100% paperless Total eClose™ platform and document preparation solution. The company concluded 2020 having performed the most eClosing transactions in its history, to the tune of a 724% increase in eClosings.

DocMagic has received the honor every year since HousingWire announced the inaugural list in 2014.

“Earning HousingWire’s Tech100 award for the eighth straight year is a testament to the incredibly dedicated team we have here at DocMagic and the passion they hold for continuous innovation,” said Dominic Iannitti, president and CEO of DocMagic. “We are elated to receive this award from HousingWire for digitizing key areas of the mortgage process and creating a superior experience across the supply chain.”

HousingWire Editor in Chief Sarah Wheeler, who has been helping to select winners since 2014, said every year the program becomes more competitive. “These companies are truly leading the way to a more innovative housing market.”

Related Content: