DocMagic named to 2021 Inc. 5000 list of fastest-growing companies

DocMagic has earned a spot on this year’s prestigious Inc. 5000 list of fastest-growing private companies in the U.S.

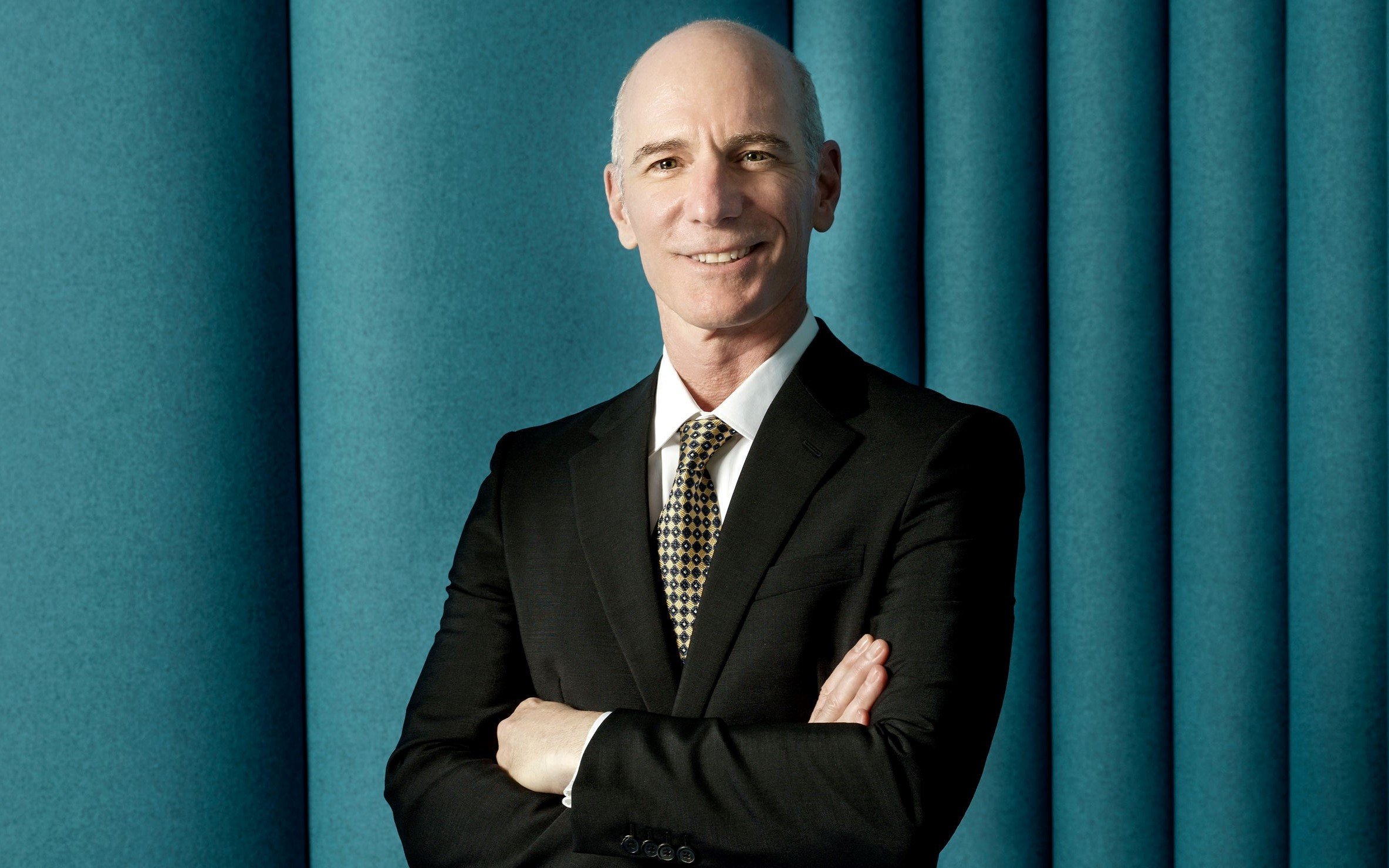

“DocMagic has been a market leader for years, so lenders naturally turn to us first when they want to elevate their processes or need to adapt to new circumstances, and that’s exactly what’s happened since the start of the pandemic,” said Dominic Iannitti, president and CEO of DocMagic. “We’re proud of our market strength, which is demonstrated in our three-year growth rate.”

“DocMagic has been a market leader for years, so lenders naturally turn to us first when they want to elevate their processes or need to adapt to new circumstances, and that’s exactly what’s happened since the start of the pandemic,” said Dominic Iannitti, president and CEO of DocMagic. “We’re proud of our market strength, which is demonstrated in our three-year growth rate.”

The Inc. 5000 ranks companies by overall revenue growth over a three-year period. Over the last three years, DocMagic tallied a growth rate of 67%, due in large part to a dramatic increase in lender adoption of its single-source Total eClose solution.

“The 2021 Inc. 5000 list feels like one of the most important rosters of companies ever compiled,” said Scott Omelianuk, editor-in-chief of Inc. “Building one of the fastest-growing companies in America in any year is a remarkable achievement. Building one in the crisis we’ve lived through is just plain amazing. This kind of accomplishment comes with hard work, smart pivots, great leadership, and the help of a whole lot of people.”

In the last 18 months, as lenders faced unprecedented challenges amid the pandemic, they increasingly turned to DocMagic’s digital mortgage advisory services, remote implementation model, and strategic approach to automating new workflows. DocMagic’s subject matter expertise and Total eClose platform helped numerous lenders successfully meet the many demands of a rapidly changing, high-volume market.

“Early on, we invested heavily in R&D to engineer the right blend of digital mortgage and eClosing technologies,” Iannitti said. “DocMagic’s ongoing growth reflects the diligent work and unwavering efforts of our entire company. We’re honored to be named to the 2021 Inc. 5000 list among so many innovative and accomplished companies.”

The first Inc. 5000 list was produced in 1982. Intuit, Dell, LinkedIn, Zillow, Zappos, Microsoft and Patagonia are among the companies that first gained national exposure as honorees on the Inc. 5000.

Related Content:

HousingWire noted that

HousingWire noted that  Garrett, who was elected in November, says his experience with DocMagic should help him make a strong contribution to the committee’s work.

Garrett, who was elected in November, says his experience with DocMagic should help him make a strong contribution to the committee’s work.

annitti was selected thanks to several key

annitti was selected thanks to several key