DocMagic's SmartCLOSE Production Ready - Receives High Scores from Lender and Settlement Providers

Press Release:

Most Feature Rich and Easy-to-Use TRID Solution in the Industry Hits a Home Run

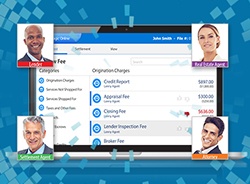

TORRANCE, Calif., Aug. 13, 2015 -- DocMagic, Inc., the premier provider of fully-compliant loan document preparation, compliance, eSign and eDelivery solutions, announced that after extensive testing by lenders, settlement providers and other relevant parties, SmartCLOSE™ has been honed to perfection and been moved to a secure cloud-based production environment for its official release date of Aug. 15, 2015.

In June, over 250 lenders participated in the testing of DocMagic's new SmartCLOSE collaborative closing portal in order to provide key feedback to DocMagic for continued fine-tuning of the system. As a result of months of preparation and testing, lender and settlement provider feedback and fine tuning the technology, SmartCLOSE is now ready for production.

"The innovative enhancements that DocMagic has added to the portal makes SmartCLOSE the most feature rich and easy-to-use TRID solution in the industry," said Kevin Marconi, COO of United Fidelity Funding. "Even though the TRID deadline was pushed to October 3, DocMagic's early readiness today gives me the peace of mind I absolutely must have to know that I am TRID ready."

"DocMagic really hit a home run with this product. We are extremely impressed with Smart CLOSE; this system is very easy for us and our settlement agent partners to utilize," said Jim Paolino, CEO of LodeStar Software Solutions, a leading technology provider for the title insurance industry. "The fashion in which the screens and workflow were developed is going to make adoption by our settlement agents quick and make their jobs easy in the new post-TRID world order."

"The DocMagic client base and strategic partners say that DocMagic has built the best TRID solution in the industry," states Tim Anderson, director of eServices at DocMagic. "Our team has diligently worked to fine-tune SmartCLOSE largely based on user feedback which has helped us get to where we are today."

DocMagic's Audit Engine maintains electronic evidence to track and log all transactions and its Compliance Engine continuously compares the initial Loan Estimate against the final to ensure RESPA compliance throughout the process. DocMagic also reps and warrants all documents created and calculations provided by the system with a complete TRID compliance guarantee. This compliance "stamp of approval" allows SmartCLOSE users to rest assured that all TRID requirements have been met.

SmartCLOSE integrates with DocMagic's LOS partners to provide seamless, bi-directional exchange of information with the click of a mouse. SmartCLOSE is also being integrated with all leading settlement platforms and other third party applications used in the loan closing process.

About DocMagic:

DocMagic, Inc. is a leading provider of fully-compliant loan document preparation, compliance, eSign and eDelivery solutions for the mortgage industry. Founded in 1988 and headquartered in Torrance, Calif., DocMagic, Inc. develops software, mobile apps, processes and web-based systems for the production and delivery of compliant loan document packages. The company's compliance experts and in-house legal staff consistently monitor legal and regulatory changes at both the federal and state levels to ensure accuracy.

For more information on DocMagic, visit http://www.docmagic.com/.

TORRANCE, Calif., June 30, 2015 -- DocMagic, Inc., the premier provider of fully-compliant loan document preparation, compliance, eSign and eDelivery solutions, is pleased to announce the hiring of Mr. Edward Komski who will assume the role of national sales manager. In this capacity, he will be responsible for introducing DocMagic's entire suite of software solutions to large, enterprise-level lending organizations.

TORRANCE, Calif., June 30, 2015 -- DocMagic, Inc., the premier provider of fully-compliant loan document preparation, compliance, eSign and eDelivery solutions, is pleased to announce the hiring of Mr. Edward Komski who will assume the role of national sales manager. In this capacity, he will be responsible for introducing DocMagic's entire suite of software solutions to large, enterprise-level lending organizations.  Press Release:

Press Release: Press Release

Press Release Join DocMagic on June 24th, 10AM PDT for a

Join DocMagic on June 24th, 10AM PDT for a

Join DocMagic on June 4th for a

Join DocMagic on June 4th for a  Join DocMagic on May 27th for a

Join DocMagic on May 27th for a  Mark Your Calendars!

Mark Your Calendars! Press Release:

Press Release: Press Release:

Press Release: